Home » Industry Watch

TPB: The New Pirate BayMore on the proposed acquisition of The Pirate Bay by Global Gaming Factory.

STOCKHOLM (Rixstep) -- A minor bout of stock market hysteria broke out the other day with the announcement of the acquisition of The Pirate Bay by Global Gaming Factory but now pundits aren't so sure they like the deal.

Where the Money Goes

The Hollywood warlords are already chomping at the bit. 'This proves TPB is run for profit', said one. 'No it doesn't', said another. 'It only proves they have something other companies find of value.'

And where will that SEK 60 million go? Outside the borders of Sweden, says Peter Sunde. TPB isn't run from Sweden anymore anyway - the money will end up with a foreign company where neither Sunde nor Neij nor Svartholm-Varg are stockholders.

Svartholm-Varg (Anakata) has intimated the money will be used to defend victims of the Hollywood warlords. Let's just see how far they get if we're as well financed as they are, wrote Svartholm-Varg.

'We're going to be after them for this money for life!!1!' said Lars Gustafsson of the Swedish branch of the IFPI.

GGF Stock 'Ballistic'

Shares in Global Gaming Factory rose by 120-150% with news of the planned acquisition. They were frozen already 22 June in anticipation of the deal. Trading resumed 10:00 30 June.

GGF's stock has been a so-called 'stamp stock' selling for a few pennies and previously was at a high of ~$0.05 before falling back to ~$0.04. But forty minutes after the stock opened for trading it began rising with 225,000 shares traded.

GGF's been in the hole as well. But not by much. Q1 results for 2009 show the company in the red for approximately $100,000. But total revenues were only $90,000 for the same period. Short term investments for $150,000, cash on hand for $100,000.

Their business model up to now has been to 'create revenue streams in the existing network of thousands of Internet cafés and gaming centres through the digital distribution of advertising, software, and services'.

The board and management of GGF have connections to a long line of IT companies including the well known Icon Medialab. Icon Medialab cofounder Johan Sellström is today CTO and board member of GGF. Board chairman Magnus Bergman sits on the boards of at least ten more IT companies and previously was board chairman of Icon Medialab.

GGF CEO Hans Pandeya is otherwise more interested in real estate. He sits on the boards of half a dozen condominium companies and several real estate companies. Previously he's been involved in ad company and media company startups all around the world.

Pandeya holds a Master of Science degree from the Royal Technical Institute in Stockholm and a Master of Business Administration degree from Harvard Business School.

Naysayers

Valdemar Ledin of Planka.nu doesn't like the new pirate bay. 'Making money isn't interesting. We want the content to be accessible. This feels like a marketing opportunity for GGF's services.'

Peter Sunde answered that yesterday evening on a Swedish national television news programme, echoing what's often heard in the open source camps. 'We never said it would be without costs. We only said it would be free.'

'We don't feel we can take The Pirate Bay any further. We're sitting in a stalemate where there's not a lot happening and there's neither people nor money to develop things any further. We've been working way too long with The Pirate Bay without anything happening. But this puts The Pirate Bay in a higher gear.'

'Things on the Internet die out if they don't continue to evolve. We don't feel we can take The Pirate Bay any further.'

There's been speculation in the past that TPB might be sold, although higher figures were mentioned at the time.

The proceeds from the acquisition will be placed in a corporation outside Sweden and be used to establish a fond to help people with Internet projects - and to defend themselves from the likes of Heinrich Pontoon.

'The idea is to finance people who are trying to save the Internet', says Sunde. 'And this financing will be transparent. A lot of the earlier criticism of The Pirate Bay was that things haven't been transparent.'

Sunde says he's happy and relieved that their amateur business will live on with more professional help. And he's not at all concerned the new owners will abuse the brand name.

'The Pirate Bay will die out if they do something the users don't like - and that's the best guarantee you can get.'

But several watersheds remain if the deal is to work. Financing is a big nut: GGF have at present very little cash and investments; and the idea to finance the acquisition with new stock emissions depends on everyone else being just as enthusiastic.

GGF CEO Pandeya says discussions of the acquisition started months ago. 'We've had good people to deal with across the table', he says. 'The founders are idealists if you ask me. All along they've been focused on creating a good environment for file sharers.'

But GGF must also pay for the software company Peerialism - and that nut is bigger than the one for TPB: SEK 100 million. Together that's SEK 160 million or ~$16 million and presently GGF have at most $150,000 available.

High Hopes

'Our plan is to compete with and ultimately eliminate today's file sharing', says Pandeya. 'It's the next generation of file sharing that's going to create value on the Internet with the help of the file sharers.'

'Content providers and creators have to get back control of their content and get paid for it. And file sharers need to be able to download faster and get a higher quality.'

Surprise Surprise!

News of the GGF acquisition of TPB dropped out of the sky. There's also been speculation that Wasa king Carl Lundström has been pushing for the deal as he might otherwise be expected to pay the entire TPB trial fine himself. 'It's easy to be an idealist when you don't have millions in damages to pay', says Sam Sundberg of SvD.

The TPB owners may have had the intention of selling out all along - and in such case $6 million has got to be one of the cheapest major acquisitions ever. But it's unlikely, says Sundberg. 'TPB's been too anti-establishment.'

Sundberg doesn't think it likely TPB will survive with the new model. 'I think it's going to be extremely difficult. Their current users won't be too interested in the new model and the site's always been a thorn in the side of content owners and providers. Getting these two groups to kiss and make up will be a huge challenge.

But we'll see. For it'd be a step in the right direction towards better commercial services for the film and games industries. It's all about making illegal file sharing unnecessary for the user.'

And if it flops - or never comes to fruition? The original founders of TPB might not be interested in starting TBP2. 'But someone else might come forward to fill their shoes', adds Sundberg.

Stockholm Bourse

'A scent of the early 2000s swept over the exchange on Tuesday', wrote E24's Torbjörn Isacson. 'Global Gaming Factory, who have almost no assets at all, are going to purchase the hyped Pirate Bay. GGF stock rose immediately by 180%. Behind the deal we find an old duo from Icon Medialab and names like Johan Staël von Holstein and Christer Sturmark.'

GGF CEO Pandeya began hyping the deal immediately, calling The Pirate Bay 'the Microsoft of file sharing'.

'The deal brings TPB to the bourse through the kitchen door', writes Isacson. 'But the risk is the kitchen door instead leads to the outhouse.'

'GGF are listed at Aktietorget, a list with constant scandals. There are a number of questionable things about both GGF and the proposed deal.'

'At the same time GGF buy TPB for SEK 60 million, whereof most of that's in cash, they're to buy technology corporation Peerialism who've developed a new file sharing technology. There they're to pay SEK 100 million, whereof at least SEK 50 million in cash.'

'But to make this work they need organised financing, approval of the GGF board, and the opinion of the board that 'the acquired assets can be used in a legal and goal-oriented fashion'.

'For 2009 Q1 GGF show liquid assets of SEK 1.5 million with just about SEK 1 million in the cash drawer. They ended Q1 with a loss of SEK 1 million - more than their total revenue.'

'Even if they were to sell a subsidiary the financing is a big question mark.'

But GGF CEO Pandeya says he can make it work through new investors. But he won't yet say who these investors are - and that doesn't make people more optimistic.

'On the contrary', says Isacson. 'The whole thing is reminiscent of the grandiose deals shot up into orbit in the early 2000s.'

Both GGF's biggest investor and board member Johan Sellström and board chairman Magnus Bergman come from Icon Medialab. Pandeya has an infected disupute with the old IT profile Johan Staël von Holstein who through his Iqube is a major shareholder in GGF.

GGF snuck in through the kitchen door to Aktietorget through the crashed 'air paté' corporation Addyourlogo that IT guru Christer Sturmark was long behind. When Addyourlogo crashed he tried to distance himself from the company but with little success. The majority holder of Addyourlogo was Alexander Richards, now indicted for fraud perpetrated at Aktietorget.

'And since then GGF's corporate career has mostly been about fishing for new money in new emissions and painting up grandiose visions', says Isacson. 'The company has also been hurting through it's low level of liquid assets and several times been truant in paying the bills.'

As late as 12 June this year their stock was being traded at SEK 0.09 (~$0.01). On 22 June there was more activity with the price rising to $0.02 and sometimes as high as $0.025.

'The stock price curve and the corporate development are undeniably reminiscent of an outhouse baked in summer heat', writes Isacson. 'The old adage that the Internet is a trend fly takes on a new meaning with GGF stock.'

'Many investors at the start of the new millennium found out their investments were mostly mold. There's a tangible risk speculators in the summer of 2009 will make the same discovery.'

Bluff?

An anonymous 'deep throat' supposedly contacted Ian Hammar of Realtid.se with the 'dark side' story of Hans Pandeya. Pandeya was supposedly involved in a number of scams in Australia and New Zealand. No proof or further information is offered and reader comments make it clear people don't hold the source (or journalist Hammar) in high regard.

Business Model

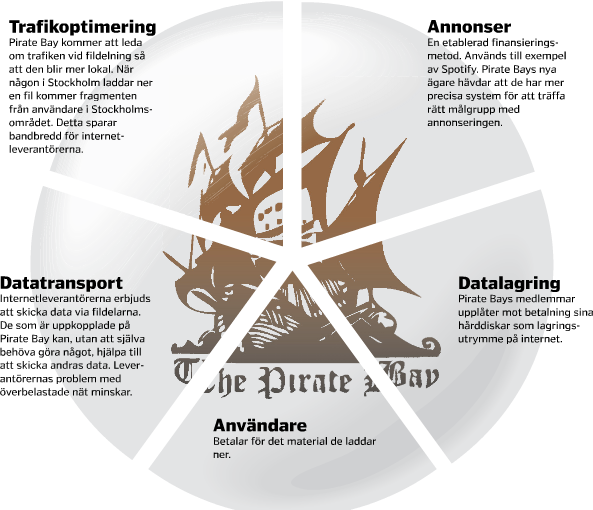

Here at any rate is the proposed business model of The New Pirate Bay as charted by SvD. There are namely five sources of revenue in this model. Counterclockwise from upper left:

- Traffic optimisation ('trafikoptimering'). The site will redirect traffic so it's more localised. When someone in Stockholm downloads a file the fragments will come from seeders in the Stockholm area. This saves bandwidth for providers.

- Data transport ('datatransport'). Internet providers will be given the opportunity to send their own data through the site's file sharers. Those connected to the site can, without direct involvement, help providers send data. This will reduce network overloads.

- Users ('användare'). Users pay for materials they download.

- Data storage ('datalagring'). Site members lease parts of their hard drives as 'Internet storage areas'.

- Advertisements ('annonser'). An established financing method. Used by Spotify. The new owners claim they have a sophisticated system for more accurately reaching applicable demographic targets.

Pundits generally agree the above plan is 'just a little bit ridiculous'. Bahnhof's Jon Karlung has already dismissed the idea GGF can get compensation from Internet providers. 'But otherwise we always welcome suggestions', says Karlung.

See Also

Radsoft: TPB Sellout

E24: IT-bubblans 2000 går igen

Realtid.se: 'Pirate Bay-köparen är en bluff!'

|